Hello, today is an infographic issue. Lots of images to drill down some few principles of personal finance.

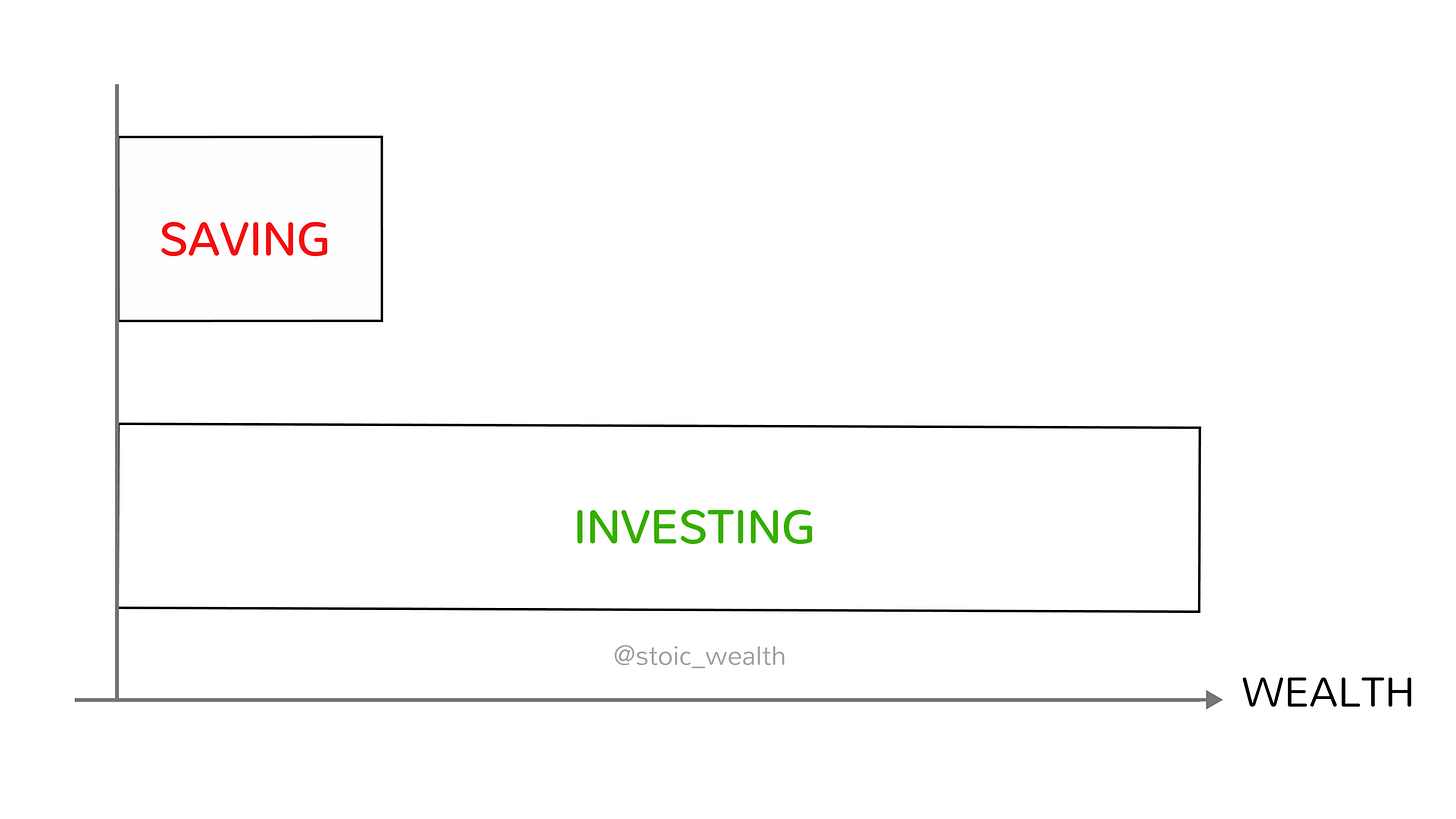

Savings is the most important determinant of financial wealth. Without savings, you can’t invest. Your saving rate is a very important indicator of your financial habits. The higher the percentage of your savings, the better.

Once you start saving, make sure you have an emergency fund. It prevents you from going into debt or an unpleasant financial situation.

If you can, do not rely on one source of income. The more, the merrier. It is always good to have more than one source of income.

Credit card debt or any non-productive debt should be avoided as much as possible. Paying interest or late payment fees will eat up your money.

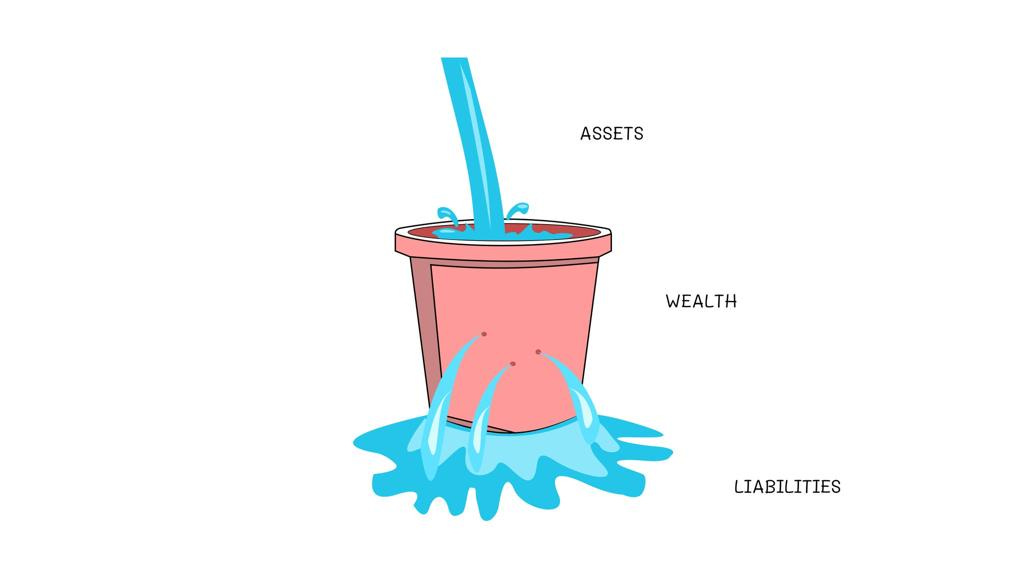

The more you earn, try to manage your spending. Wealth is Assets-Liabilities. If your liabilities increase with your assets, you aren’t getting any richer.

Saving is not enough. Start investing once you have your emergency fund and debt sorted out. Investing compounds. Your savings can only dream of compounding the way investing does. You can’t save your way to wealth. Investing in yourself is the best investment you can make.

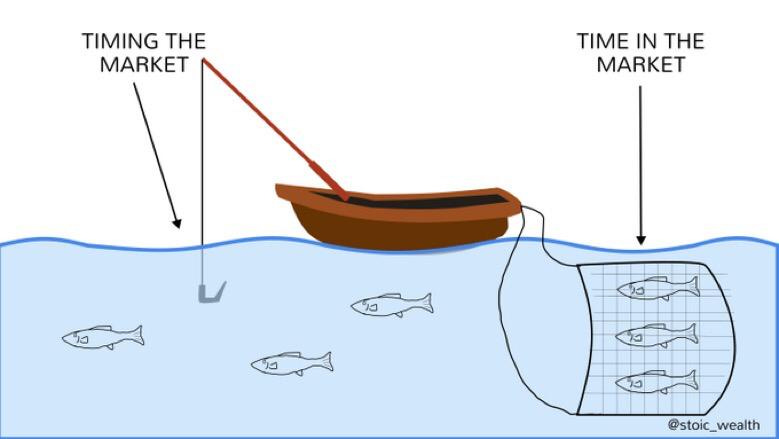

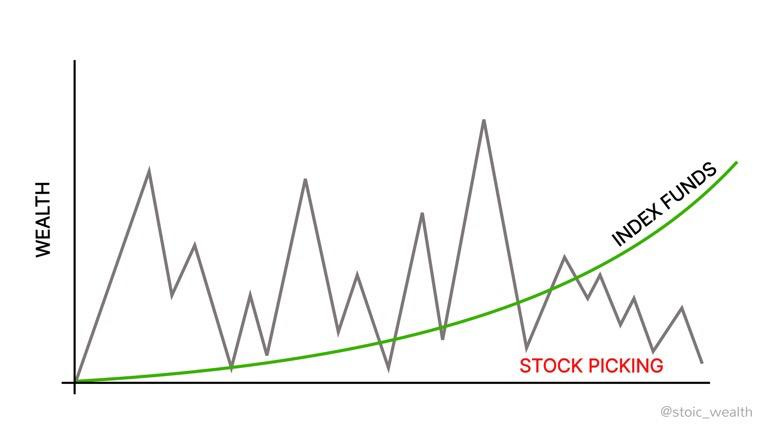

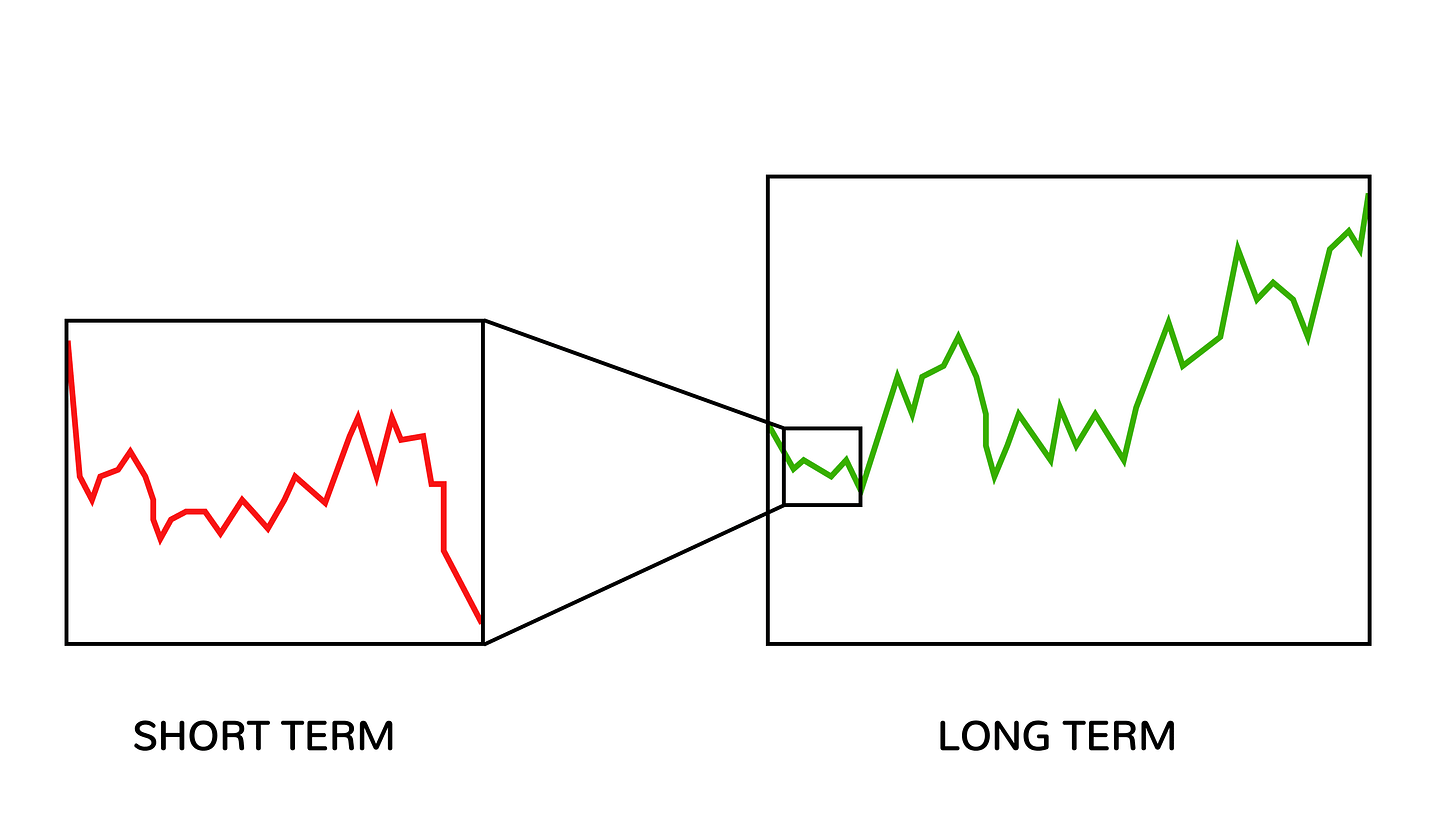

Time in the market is the easiest way to get wealthy. The longer you invest, the higher the probability of becoming wealthy. Timing the market is akin to looking for a needle in a haystack. Why not buy the whole haystack?

The shorter the time horizon, the more the volatility. Over a long time, the market goes up and to the right.

I love love the visuals! Thank you for sharing

Thanks for the great insight!