How to lose $20B in 2 Days

How smart men go broke

Hi everyone,

It's been a while! I got busy with work and wasn’t giving this newsletter the attention it deserved.

But I'm back! And so grateful for everyone who checked up on me and asked about the newsletter.

Thanks for sticking around.

In other news: I was interviewed by Fareedah from the PaperMoth’s Non-Guide you can check it out here.

Also, today, I’d be on Instagram Live with Tope Salahudeen to discuss how to increase your income with content writing by 2:30 pm WAT.

Now to today's piece 🤝

Leverage

In layman’s terms, leverage is the exertion of force utilizing a lever. This means leverage/ a lever is a (force) multiplier.

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” - Archimedes.

A lever only increases the intensity or further propagates energy/force, for good or bad.

A lever on its own can’t do anything. Multiply anything by zero, and you still get zero.

“Leverage magnifies outcomes but doesn’t add value.” -Howard Marks.

For example, to break a coconut, you’d use your hands to smash it against a stone. Better yet, you can use a nutcracker to do so quickly. The nutcracker here is the force multiplier. It is the leverage.

When people wanted to fight, they initially used their bodies (hands and legs) to decimate their opponents. They used knives, swords, bows, and arrows as time went on. The number of men that can be killed increased. The force or energy required to do so is reduced. Further down the line, guns came to be, and the number increased. Then bombs and other weapons of mass destruction.

With each improvement, the energy required to kill reduced and the number of men that could be killed increased. This is also leverage.

Everyday use of leverage includes car loans, mortgages and student loans.

In investing, leverage is debt used to undertake a venture. If the venture fails, the failure is multiplied, and if it is successful, leverage multiplies the success.

How does leverage work

Using the stock market as an example, let’s say Mr T has $1,000 in his account for buying stocks. He can decide to be leveraged 10X1. This means he borrows ten times the amount($10,000). Then he trades. If he makes a profit, he gets only to return the $10,000 he borrowed, and the rest is his to keep. However, if he is unfortunate to incur a loss, he has $10,000 to pay back.

The Risk

Similar to how levers magnify forces, profits and losses are magnified by leverage.

“Leverage is a two-edged sword. It’s wonderful when the trade is going up, but you’re out of business quickly when it goes the other way.” -Craig Effron.

Let us assume that Mr T’s venture has a profit of 10%. With his $1000, his gain is a measly $100. However, if he is leveraged 10X, he gets a profit of $1100, more than the amount he initially had. He has doubled his money after returning the initial $10,000 he borrowed.

If you liked this post from Muhammad’s Newsletter, why not share it?

Suppose we assume that Mr T’s venture has a loss of 10%. When he is not leveraged, he loses only $100 and is left with $900. If he is leveraged 10X, he loses $1100 and is left with $9,900, and he has to return $10,000.

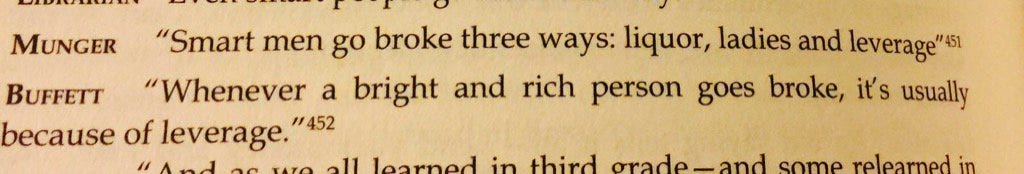

Smart men

“Smart men” are usually over-confident about how much they know about the market. They believe the market would go in a particular direction. They then leverage their portfolios, the market goes irrational as it does most times, and they get ruined completely. This is how you lose $20 billion in 2 days.

A lot of warns have been given against using leverage to trade. It takes a burn for a baby to dread fire. Unfortunately, not all burns are survived.

‘‘If you’re smart, you don’t need it, and if you’re dumb, you don’t want to use it.’’ -Warren Buffet.

Until next week, take care!

Muhammad Tahir

In ratio term 10:1